1. Editor's Note

This week, the cryptocurrency market endured its most destructive volatility cycle since the beginning of 2026. What began as a defensive consolidation earlier in the week evolved into a lethal "Black Sunday" collapse on February 1, as a systemic liquidation storm hit the market during the liquidity-thin weekend. Bitcoin plummeted from near $88,000 to briefly pierce $76,000, erasing all gains from early January and triggering a staggering $2.2 billion in single-day leveraged liquidations.

[Personal View] This week's market trajectory reveals a critical macro misalignment: while investors widely expected cryptocurrencies to act as "Digital Gold" during macro turbulence, the asset class exhibited extreme Beta characteristics. It fell in tandem with safe havens like gold and silver, which dropped between 10% and 26%. This "homogenization" of asset classes reflects an indiscriminate sell-off of high-liquidity assets to meet margin calls amid global liquidity tightening expectations.

Regarding capital flows, spot Bitcoin ETFs ended a two-week streak of inflows, pivoting to massive net outflows. On January 29 alone, $762 million left these products, signaling that institutional investors are in a period of aggressive position adjustment amidst geopolitical uncertainty and shifting interest rate narratives. Simultaneously, a significant contraction in the USDC supply further corroborates the exit of institutional capital.

[Personal View] The core conclusion is that the resilience of the 2026 market is undergoing its ultimate test. While institutions like JPMorgan still project strong institutional inflows for the remainder of the year, the market must first purge the excessive leverage accumulated in 2025. This downturn is not an isolated crypto event but a "stampede exit" from global financial markets where capital has become highly concentrated. Regulators' statements, such as the SEC’s guidance on tokenized securities, while bullish for compliance in the long run, are currently exacerbating the survival pressure on "crypto-native" entities. These growing pains are the pricing costs the market must bear.

2. Market Overview

As of February 1, 2026, 23:59 UTC+8, the total crypto market capitalization stands at $2.97 trillion, down approximately 10.5% from the start of the week. Bitcoin dominance (BTC.D) rose to 59.2% during the turmoil, reflecting capital retreating to the most liquid core assets. Ethereum continued to underperform, with its market share hitting a multi-month low of 10.9%.

Weekly Performance of Major Assets

Data sources: CoinMarketCap, Amberdata

Market Metrics Analysis

- Fear & Greed Index: Dropped to 24 (Extreme Fear) this Sunday, down from 29 (Fear) at the week's start. This is the lowest reading since November 2025.

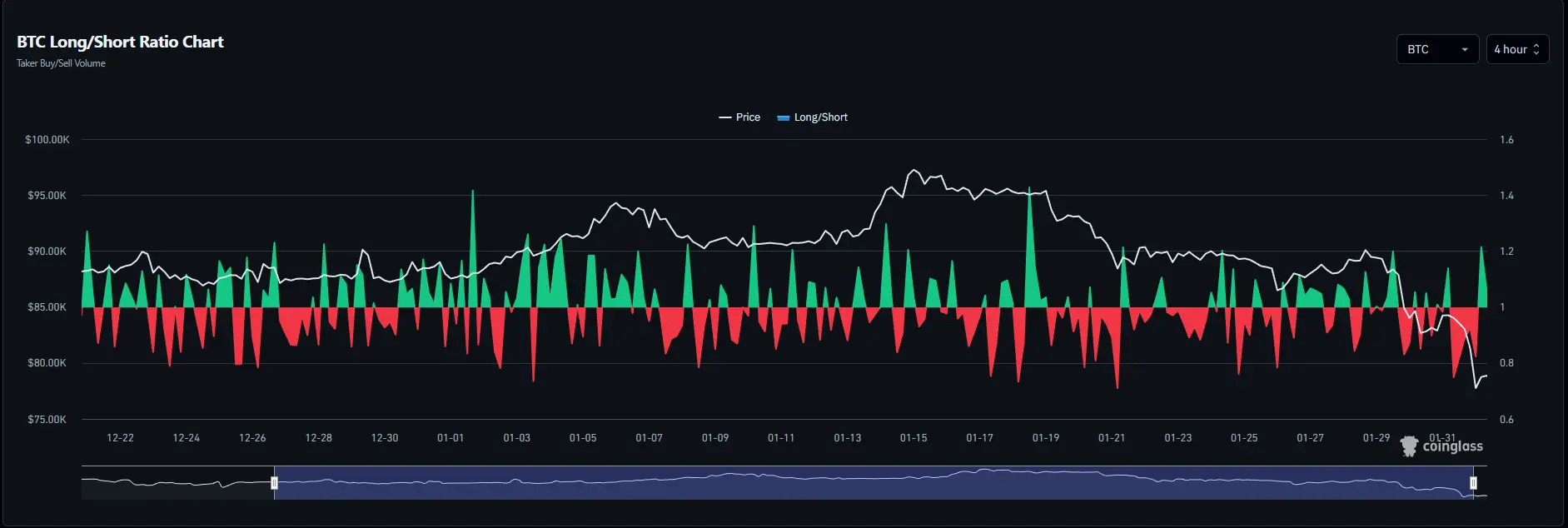

- Funding Rates: Due to massive weekend liquidations, average BTC perpetual funding rates flipped negative to around -0.005%, indicating a flush of long positions and a bearish short-term bias.

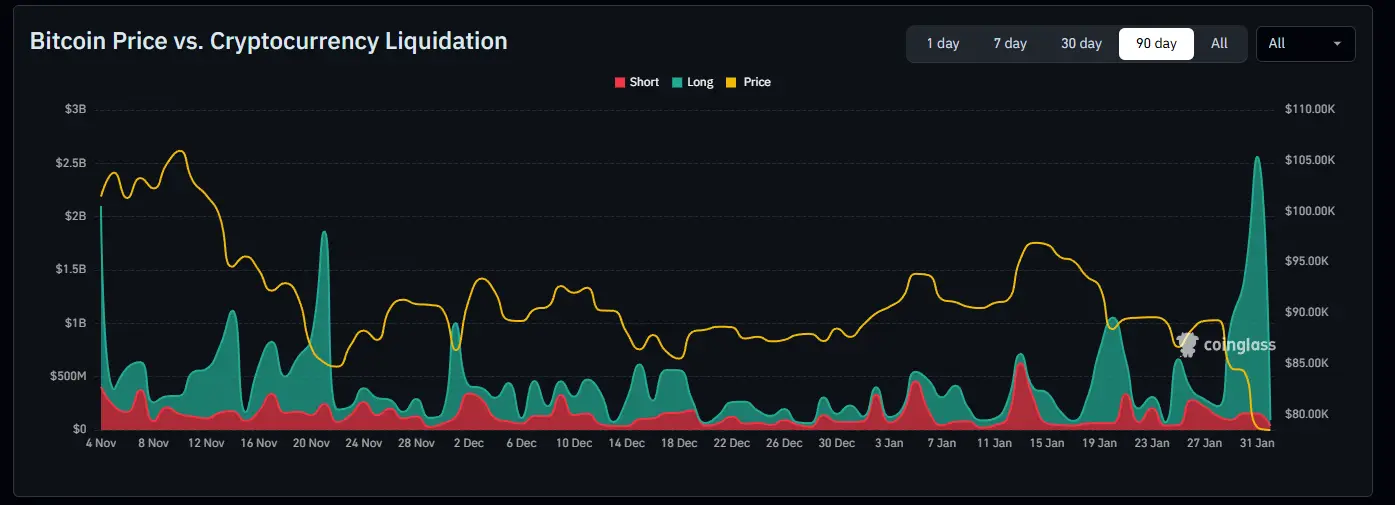

- Liquidation Distribution: Between Jan 31 and Feb 1, long liquidations accounted for over 90% of the total. Bitcoin’s drop below $80,000 and Ethereum’s breach of $2,800 triggered a cascade of algorithmic forced selling.

3. Top Stories

- "Black Sunday" Triggers $2.2 Billion Liquidation: In the early hours of February 1, Bitcoin briefly hit $76,000, causing over 335,000 investor accounts to be wiped out in 24 hours. This marks the highest single-day liquidation since the October 2025 crash, with ETH long liquidations nearing $1 billion.

- SEC Releases Official Statement on Security Tokenization: On January 28, the SEC clarified the application of federal securities laws to tokenized assets. While permitting issuer-sponsored models, it issued stern warnings regarding the risks of security-based swaps in third-party sponsored tokenization.

- White House Invites Titans to Crypto Summit: A discussion scheduled for February 2 will focus on crypto market structure legislation. David Sacks confirmed that the Clarity Act is set for a pivotal markup to define SEC and CFTC jurisdictional boundaries.

- Rare Crash in Gold and Silver Prices: Between Friday and Sunday, spot gold dropped below the $5,000 mark (over 10% decline), and silver plummeted 26%. This collapse in traditional safe havens amplified the panic selling in the crypto market.

- Ethereum Completes "BPO" Hard Fork: As part of the Fusaka upgrade series, Ethereum successfully implemented the BPO maintenance update this week, optimizing parameters to support massive L2 scaling. Despite technical progress, ETH fell over 17% due to macro factors.

- JPMorgan Forecasts Accelerated Institutional Inflows for 2026: Analyst Nikolaos Panigirtzoglou expects that following the $130 billion inflows in 2025, the passage of regulatory bills will trigger more institutional VC and M&A deals in 2026.

- OSL Group Secures $200 Million in Financing: On January 29, the compliant exchange OSL announced a massive equity round aimed at global stablecoin payment infrastructure, demonstrating that compliant sectors remain a target for heavy capital during turmoil.

- UK ASA Bans Coinbase Ads Across the Board: The regulator ruled that Coinbase ads suggested crypto could alleviate the cost-of-living crisis with insufficient risk disclosure, marking a near-zero tolerance for crypto marketing in the UK.

- Quantum-Resistant Bitcoin Testnet Launches: Facing risks that $2 trillion in BTC could be vulnerable to quantum computing, the "Bitcoin Quantum" testnet launched this week, offering a sandbox for post-quantum cryptographic migration.

- XRP Escrow Amendment Reaches 82% Consensus: Set to activate in mid-February, this amendment aims to optimize XRP governance in escrow accounts, enhancing institutional transparency for cross-border settlements.

4. Sector Deep Dive

Sector 1: DEX (Decentralized Exchanges)

Driven by extreme volatility, DEX volume reached $86.7 billion this week, up 3.9% WoW. Solana-based exchanges were particularly active, handling over $48 billion in trades.

Analysis: The surge in volume did not translate to TVL growth; instead, global DeFi TVL hovered around $57.3 billion as asset prices collapsed. Solana LPs faced heavy impermanent loss as prices retraced, yet the massive volume signifies intense battlegrounds at the $80,000 level.

Sector 2: RWA (Real-World Assets)

While the SEC’s statement was stern, it effectively provided a legal foundation for regulated RWA paths. This week, tokenized treasuries and gold assets demonstrated relative price resilience amid the market rout.

Analysis: Tokenized gold projects (XAUT/PAXG) outperformed prior to Friday’s dip. Although they eventually corrected with the spot market, their overall resilience was superior to native crypto assets. The RWA sector's 7-day APY remains between 5%-8%, making it a primary "safe harbor" for capital on-chain.

Sector 3: Perpetual (Decentralized Perps)

The Perps sector experienced the most extreme "long squeeze" since early 2026. Total weekly Perp volume reached $277.6 billion, up 29.14% WoW.

Analysis: Funding rates flipped negative across the board on Sunday, indicating that leveraged longs have been purged. Hyperliquid’s OI growth reflects hedging demand from professional traders during bottom volatility. The market is currently in a "Deep Negative Gamma" zone, meaning small sell-offs can trigger outsized drops as liquidity recovers.

5. On-Chain Highlights

- Liquidation Record: Total weekly liquidations reached $2.85 billion, with $2.2 billion occurring on February 1—a 15-month high.

- Active Addresses Drop: BTC average active addresses fell 6% WoW to 885,000, signaling that retail participants are stepping back amidst the decline.

- Stablecoin Outflows: USDC supply contracted by $3.6 billion this week, the largest single-week burn since late 2024. In contrast, USDT held steady at $187 billion, suggesting that US institutions are leading the "de-risking" redemption phase.

- Realized P/L: Weekly realized profit dropped from $1 billion to $183 million, indicating that early profit-takers have exited, and the market is now dominated by Short-Term Holders (STH) in unrealized loss.

- Whale Alert: An Abraxas Capital fund moved 2,038 BTC to Kraken when prices broke below $81,000, triggering the second major wave of selling.

- LTH Selling Slows: Long-Term Holders realized only 12,800 BTC in profit per week—down 90% from cycle peaks—indicating that long-term capital is shifting into wait-and-see mode.

- Gas Fee Volatility: Ethereum Gas fees hit 45 Gwei on Sunday during the liquidation peak as automated protocols competed for block space to close or re-collateralize positions.

- Exchange Inflow: A net inflow of roughly 12,000 BTC hit major exchanges this week, mostly from recent buyers cutting losses or seeking derivative hedges.

6. Funding & Project Updates

Primary markets remained incredibly active this week, with total financing exceeding $1.1 billion. Capital is focusing on compliant infrastructure, payment networks, and stablecoin solutions.

Weekly Funding Table

Data sources: Phemex News, Crypto Fundraising

Upcoming Major Project Milestones

- SUI Massive Unlock: On February 1, SUI unlocked approx. 54 million tokens (~$80 million), or 0.54% of supply. On-chain activity helped absorb some of the pressure.

- Berachain (BERA) High-Risk Unlock: On February 6, Berachain is expected to unlock 63.75 million tokens, approx. 59.03% of the current circulating supply—the largest liquidity risk for next week.

- Zama Token Claim: Following the Jan 21-24 auction, Zama will open token claims on February 2. These $ZAMA tokens are fully unlocked and usable for protocol fees.

- XinFin (XDC) Targeted Unlock: February 5 will see the unlock of 841 million XDCE tokens (5.36% of supply) targeted at enterprise partners.

- MegaETH Mainnet Launch: This week, MegaETH launched its mainnet, aiming to drastically improve L2 execution performance.

7. Regulation & Macro

Macro & Geopolitics

The crash in gold and silver was a leading indicator of a shift in the macro environment. Facing potential upward pressure on interest rates and a correction in asset bubbles, capital exited over-extended precious metals and crypto assets first.

Regional Regulatory Updates

- United States: Beyond the tokenization guidance, the SEC is working with the CFTC on "Project Crypto" to harmonize rules. However, a digital asset bill was stalled in the Senate Agriculture Committee due to bipartisan disagreements over political ties.

- European Union: Circle announced it is the first global stablecoin issuer to fully comply with MiCA, paving the way for EURC expansion in the EU.

- United Kingdom: The ASA banned Coinbase ads for misleadingly linking crypto investment to the UK cost-of-living crisis with inadequate risk disclosure.

- India: The government will implement a comprehensive digital asset monitoring system from 2026 to enhance AML and tax tracking.

Weekly ETF Flow Report

Spot Bitcoin ETFs hit a wall after weeks of strong inflows, with net outflows recorded in four of the five trading days this week.

Data Sources: SoSoValue, Bloomberg

8. Chart of the Week

1. BTC Network Liquidation Heatmap

The chart clearly shows high-concentration liquidation clusters as BTC breached $85,000 and $80,000. Algorithmic stop-losses triggered a liquidity vacuum near $76,000, causing a "stampede."

2. Long/Short Ratio & Funding Rates

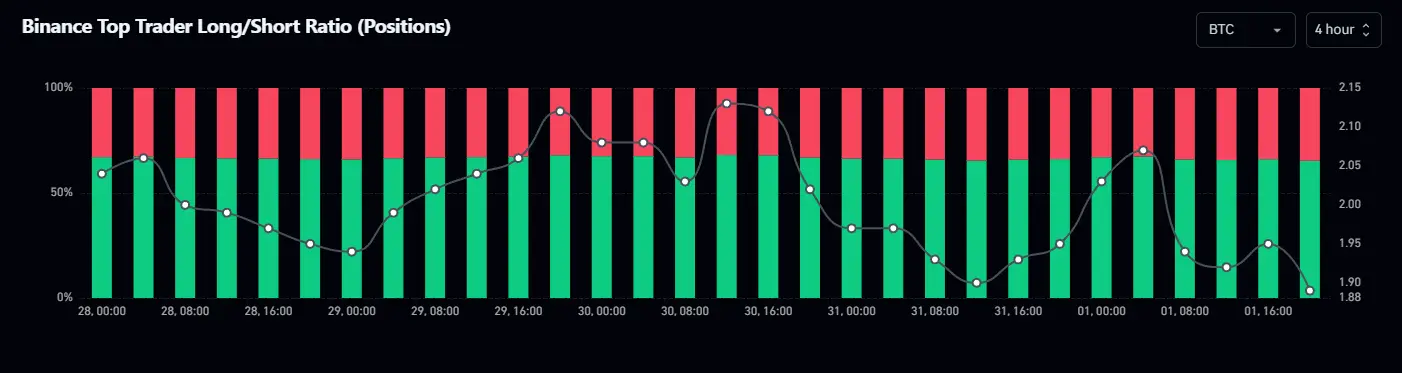

Funding rates crashed from over 50% APR in early January to negative territory. Retail longs were "wiped out," and the Top Trader L/S ratio compressed from 1.45x to 1.1x—a sign of completed deleveraging.

3. Top Trader Position Changes

This chart reveals that institutions, including Abraxas Capital, began de-risking on Friday, while retail was forced to exit during the Sunday price collapse.

9. What to Watch Next Week

- Feb 2 White House Crypto Summit: Negotiations over the Clarity Act could provide the necessary relief sentiment to repair this week's damage.

- Berachain (BERA) 59% Supply Unlock (Feb 6): The massive unlock volume may cause concentrated sell pressure in the second half of the week.

- Zama ($ZAMA) Claims Open: As a privacy infrastructure leader, its market performance will define the valuation ceiling for 2026 projects.

- BTC ETF Inflow Reversal: Whether institutions buy the dip is the only quantitative metric to distinguish a "deep flush" from a "bear turn".

- Geopolitical Escalations: Watch the impact of Middle East tensions on commodities; further gold weakness could lead to continued crypto correlation sell-offs.

- Ethereum Ecosystem Resilience: After breaching $2,400, monitor if L2 activity on Arbitrum and Base remains healthy.

- Fed Rate Cut Re-Pricing: Key inflation indicators next week will cause shifts in 3-month rate cut probabilities.

- XRP Escrow Amendment: If 82% consensus holds, XRP may decouple and show independent strength late in the week.

- Banking & Crypto Outcome: Watch for permits allowing banks to settle via stablecoins, which would directly impact RWA valuations.

- Open Interest (OI) Bottoming: If market-wide OI stabilizes above $70 billion, it would signal the start of a multi-week consolidation and repair phase.

10. Closing & CTA

Thanks for reading AscendEX Web3 Weekly

Subscribe for weekly delivery: https://ascendex.com/en/digest

Trade Bitcoin and 800+ cryptocurrencies: https://ascendex.com

This report is for informational purposes only and does not constitute investment advice. Cryptocurrency prices are highly volatile. Invest responsibly. AscendEX assumes no liability for the content of this report.